Case Study

Empowering Users Through Self-serve Surcharging

Designing Safe Self-Serve Experiences in High-Risk Financial Systems

Role

Lead Product Designer

Team

PM, Engineering squad 1

Timeline

4 weeks

Overview

Surcharging is a feature that directly impacts money, legality, and user trust.

A single mistake can result in financial disputes, legal exposure, or customer churn.

This project focused on turning a high-risk, rules-based configuration into a safe, understandable, and self-serve experience—without hiding complexity or shifting liability onto the system.

The Problem

At first glance, surcharging looked like a UI complexity problem without context.

In reality, it was a much deeper tension between:

- Business risk

- User anxiety

- Compliance complexity

The existing model relied on a flat-rate configuration managed through Customer Support.

This created a broken operating model:

Business pain

- Supplier churn

- CS ticket overload

- Legal and compliance risk

- Competitive disadvantage

Supplier pain

- No self-serve control

- Heavy CS dependency

- Anxiety around compliance and mistakes

The real challenge wasn’t how to make the UI simpler. It was how to let suppliers move fast without exposing them—or the company—to legal and financial risk.

How might we let suppliers move fast without exposing them to legal and financial risk?

My Role

I was the Lead Product Designer on this project and owned:

- Problem framing

- UX strategy

- Design decisions and trade-offs

- Cross-functional alignment through delivery

Constraints

- Legacy product → No mature design systems

- Limited engineering capacity(resources)

- Legal and regulatory risk

- Tight delivery timeline

Challenges → Solution

Three Critical Challenges

1. A broken operating model

Flat-rate surcharging led to CS dependency and supplier churn.

2. Enabling self-serve without increasing risk

Suppliers needed self-serve control, but compliance anxiety remained high.

3. Shipping under real constraints

No design system, limited resources, and the need to ship quickly.

Challenge 1: What Users Actually Needed

Insights gathered from:

- Interviewing Customer support team

- Customer support team’s records with customers

- Supplier feedback

- Legal team guidance

They weren’t asking for a fully flexible rule engine.They wanted to understand what would happen—and trust that they weren’t making a costly mistake.

Users didn’t want more complexity. They wanted safe control.

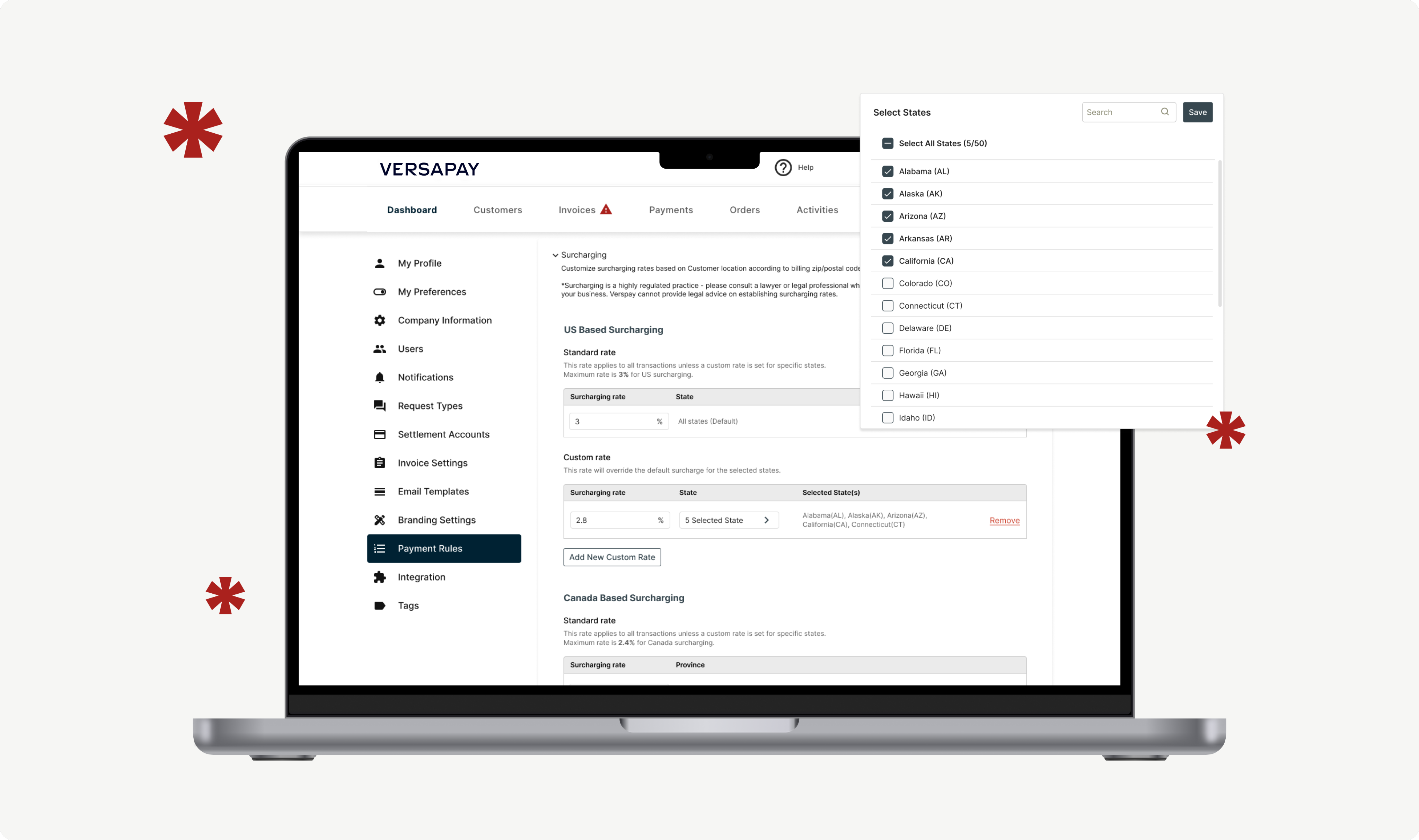

Solution: Safe, Scoped Self-Serve Setup

Instead of designing maximum flexibility, PM and I intentionally scoped the solution.

Key design decisions

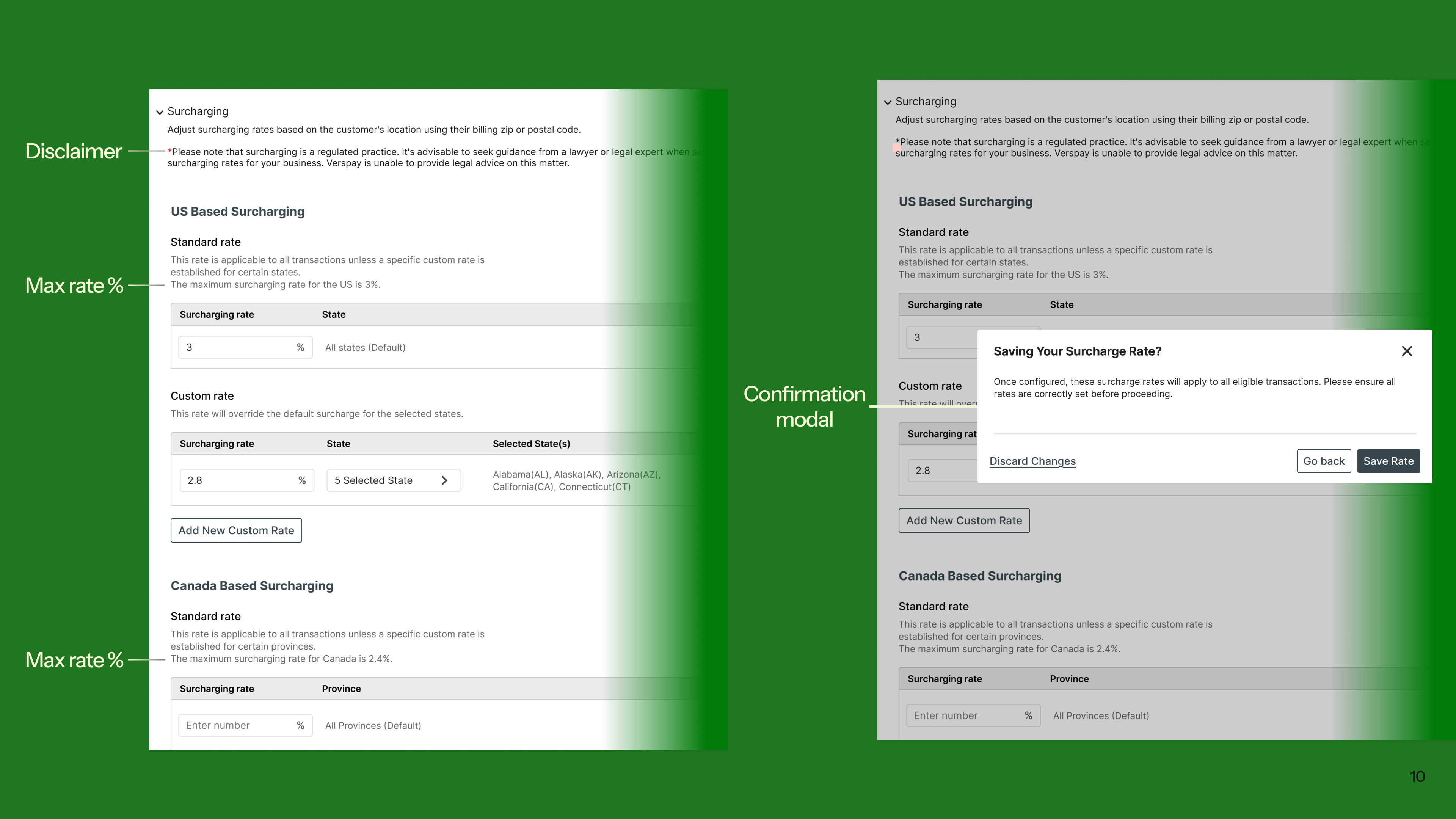

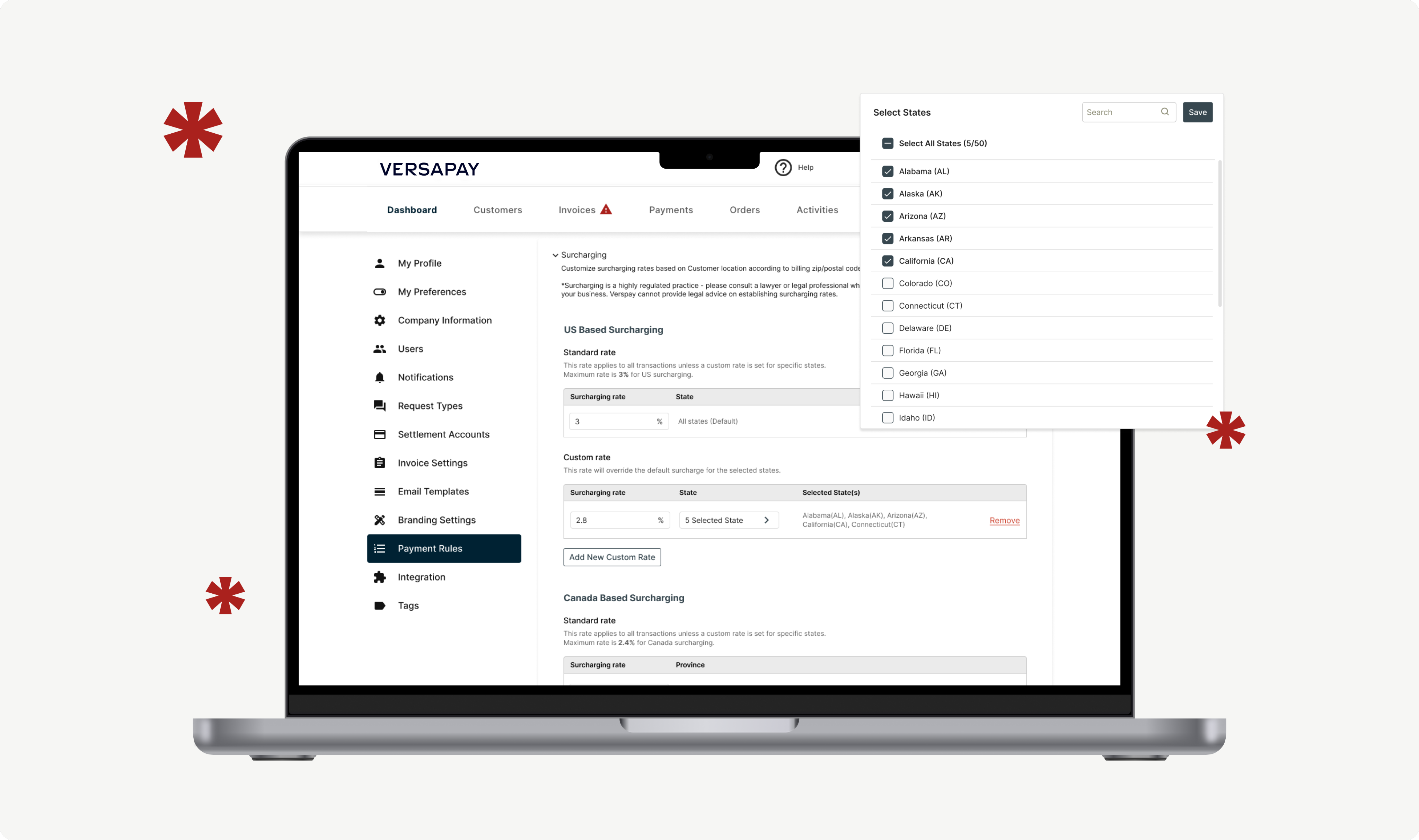

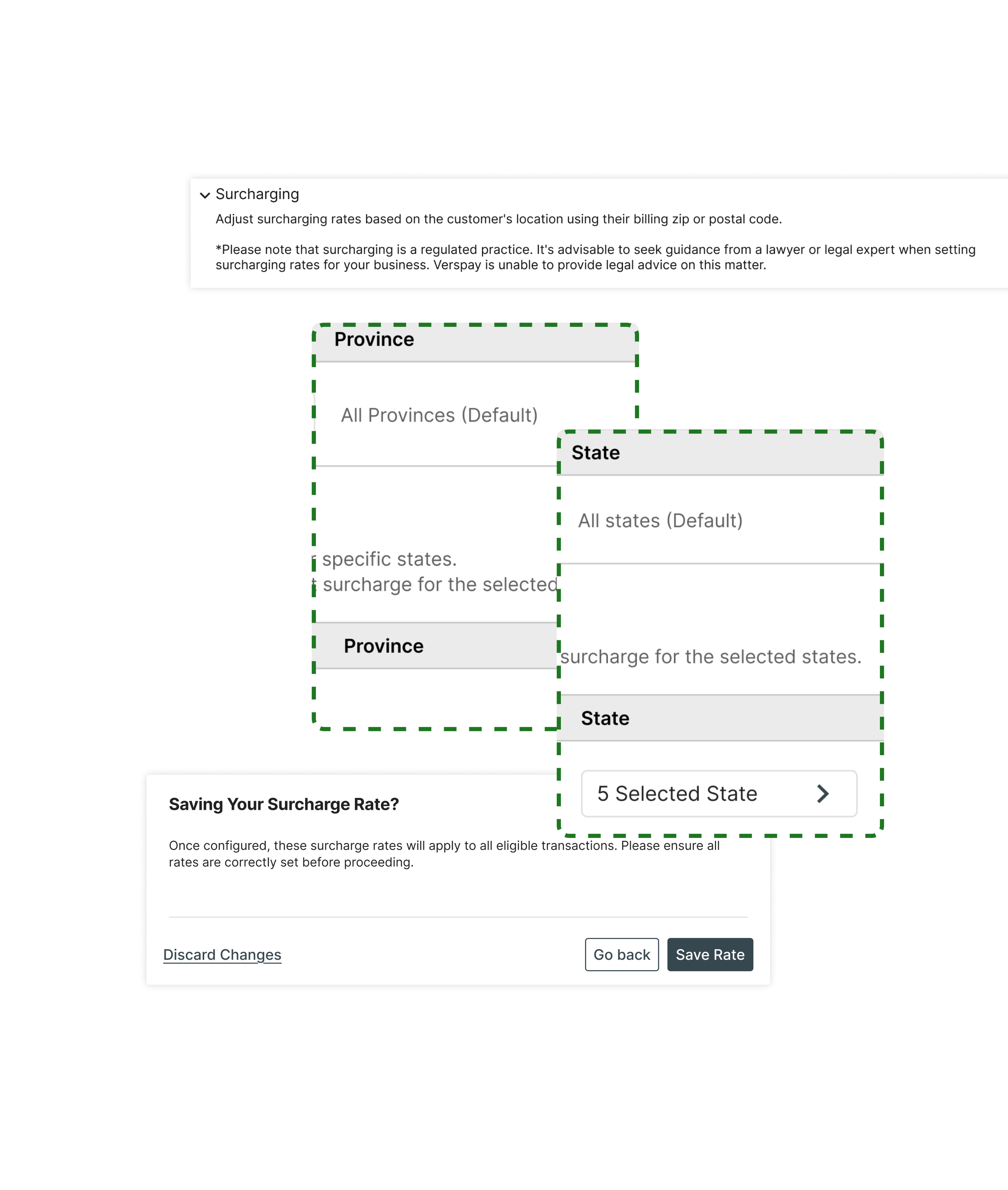

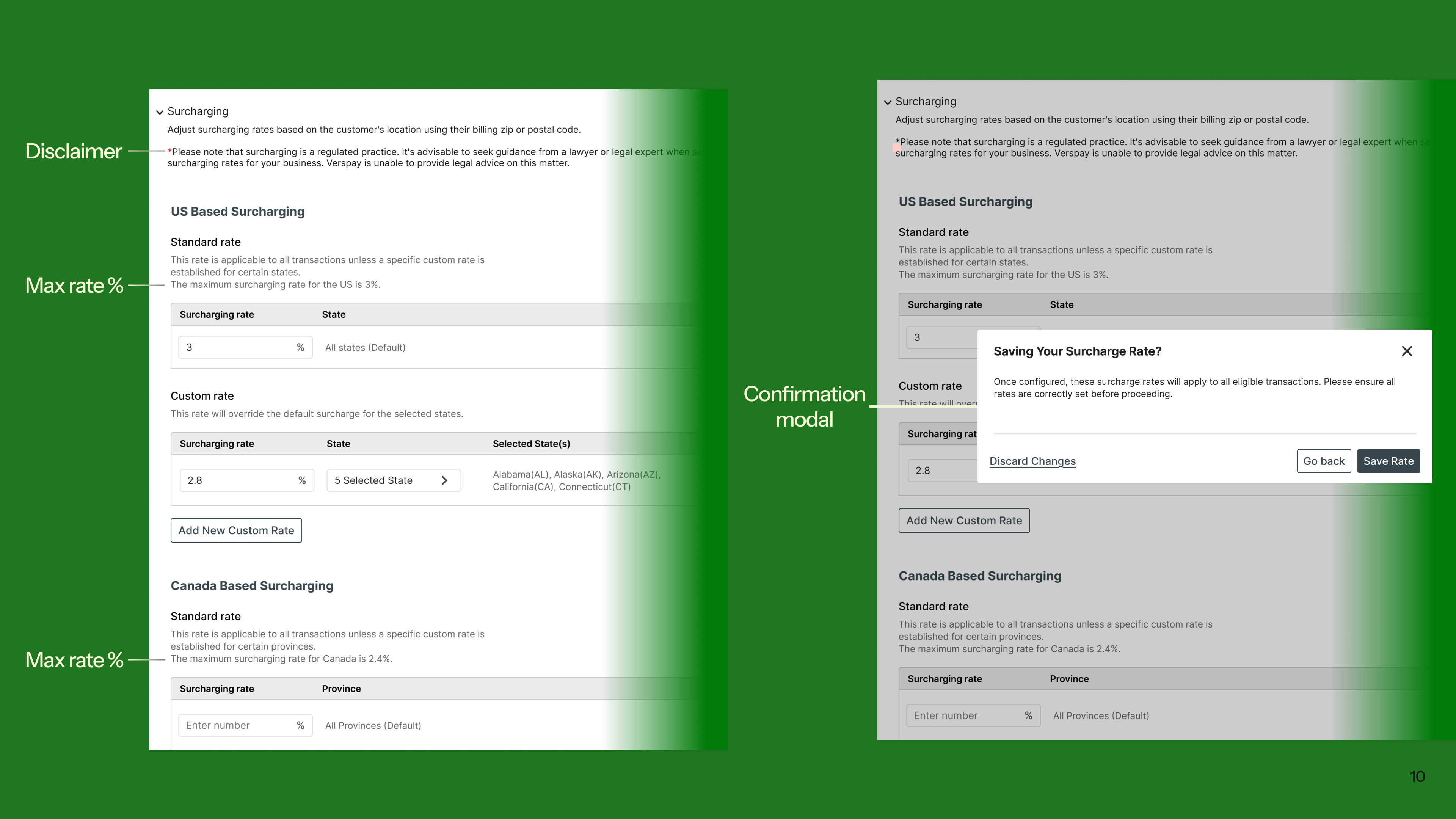

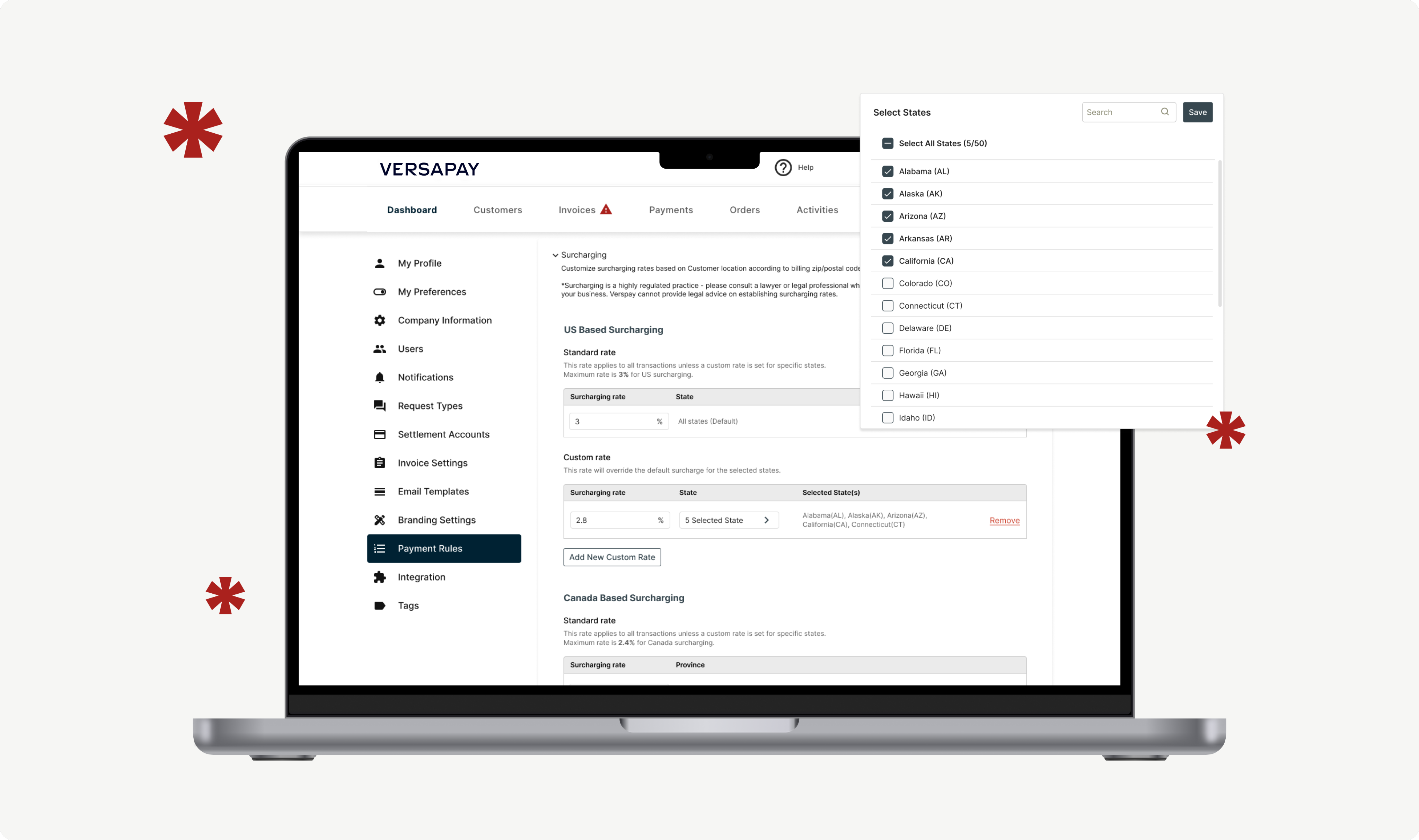

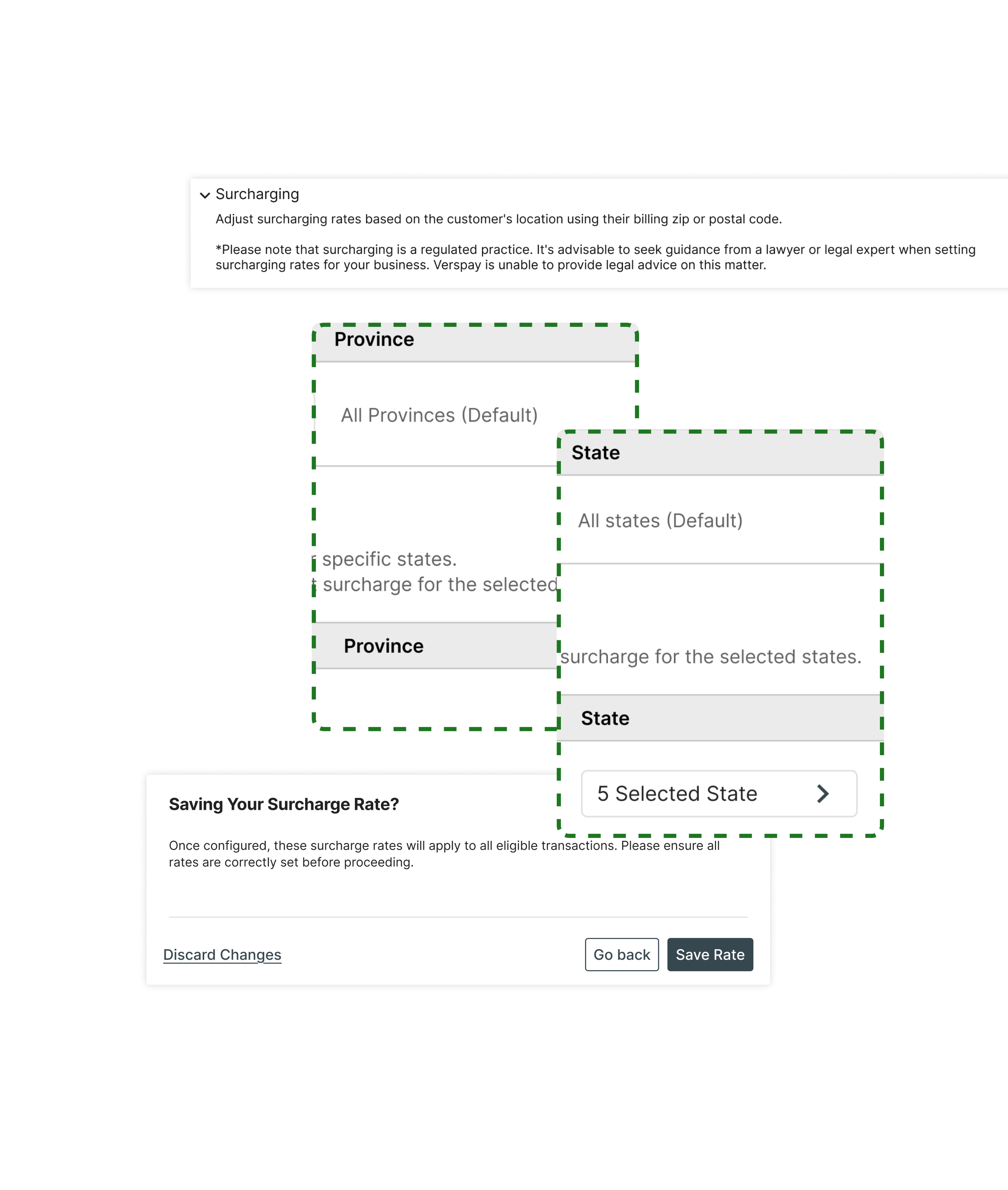

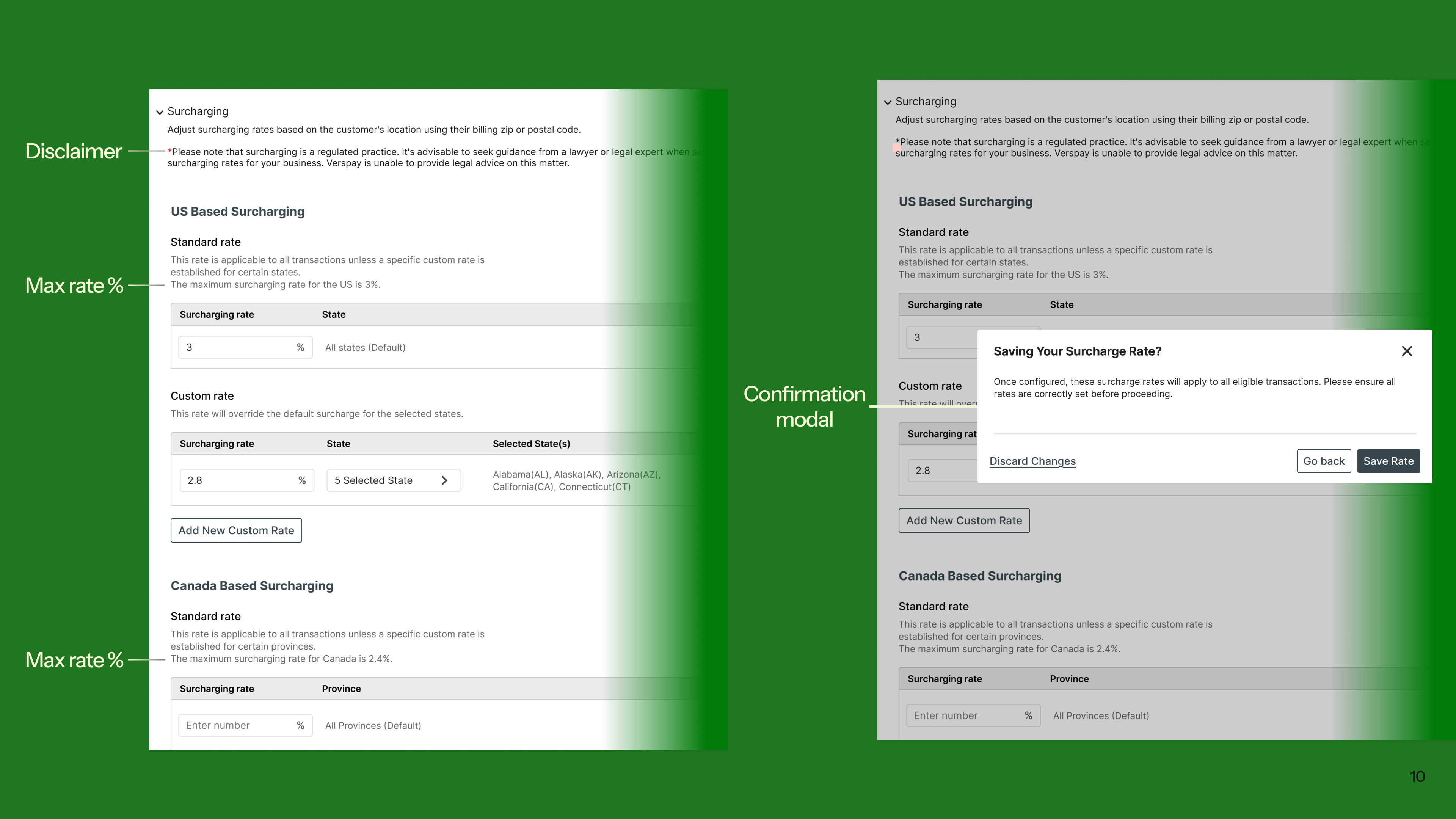

- State / province-level configuration

- Explicit condition building

- Visible maximum surcharge percentages (US & Canada)

- Review-first mental model before saving

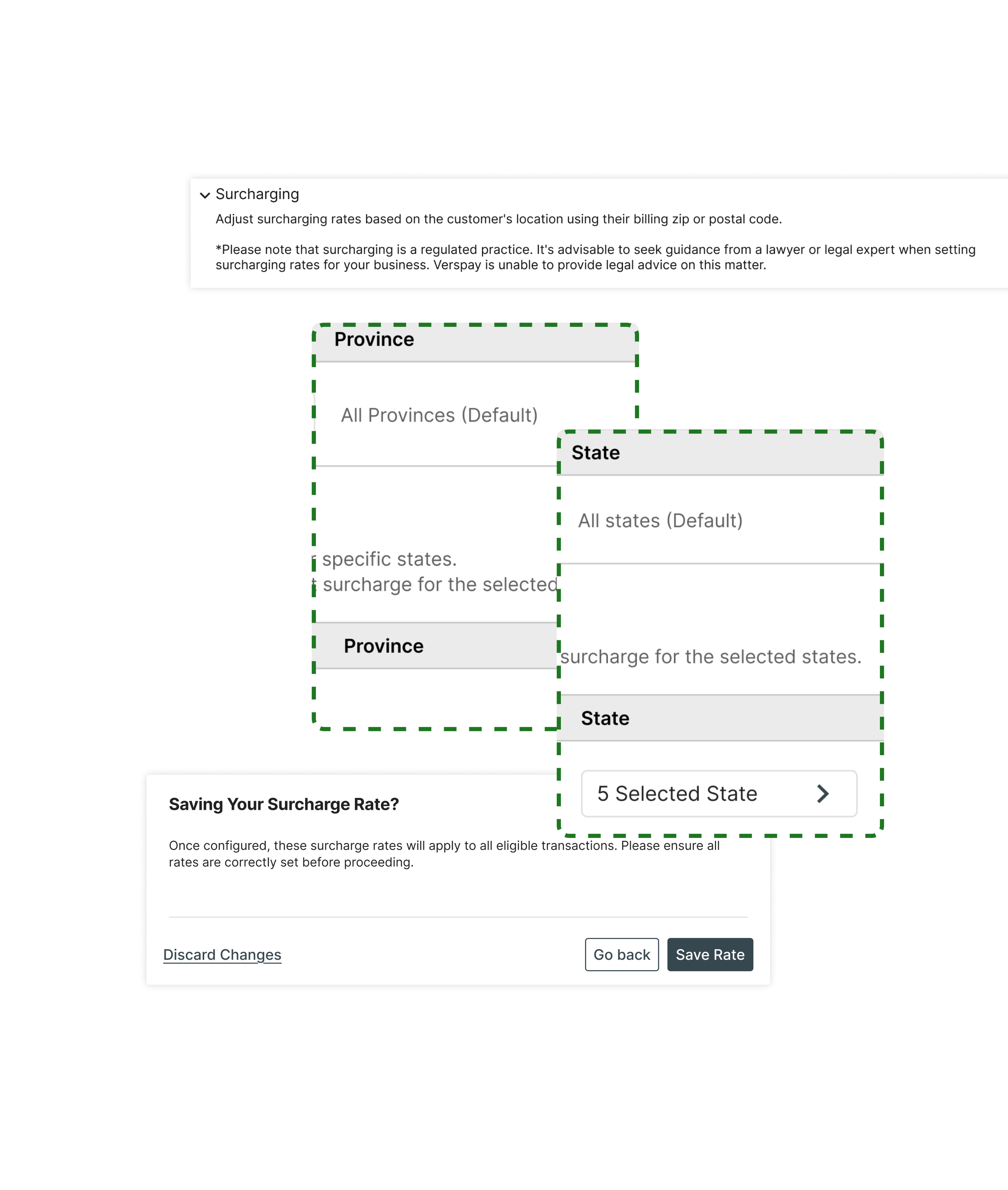

Challenge 2: Guardrails Where It Matters

Not all friction is bad.

In high-risk financial flows, removing friction everywhere can create serious problems.

I focused on adding protection only at critical moments.

Solution: Guardrails included

Instead of designing maximum flexibility, PM and I intentionally scoped the solution.

- Legal-aligned disclaimers

- Confirmation modal before saving

- Clear awareness of where rates would apply

These moments slowed users down intentionally. Not to block progress, but to prevent irreversible mistakes.

Challenge 3: Shipping Fast Under Real Constraints

The solution still needed to ship quickly.

No design systems + Lacking resources

→

Reused familiar UI patterns

Engineer-friendly components

→

2 weeks delivery (Design)

1 sprint implementation (Eng)

Faster than PM expectation

Outcome & Proof

While long-term metrics were still evolving, early signals were strong:

These outcomes validated the approach without over-claiming final impact.

26%

Reduced Customer Support team dependency (tickets)

70K+

in revenue during the first week

Positive

qualitative supplier feedback

Kudos

Strong recognition from Product and CS teams

Reflection

What This Project Demonstrates

- Designing for risk, not just usability

- Strategic scoping under technical and legal constraints

- Turning regulatory complexity into clear mental models

- Knowing when to add friction intentionally

- Owning discovery → delivery → storytelling

Warning modal before user saves the surcharging

Surcharging reinforced something critical for me:

Good UX isn’t always about speed—it’s about confidence, clarity, and accountability, especially when money and compliance are involved.

Case Study

Empowering Users Through Self-serve Surcharging

Designing Safe Self-Serve Experiences in High-Risk Financial Systems

Role

Lead Product Designer

Team

PM, Engineering squad 1

Timeline

4 weeks

Overview

Surcharging is a feature that directly impacts money, legality, and user trust.

A single mistake can result in financial disputes, legal exposure, or customer churn.

This project focused on turning a high-risk, rules-based configuration into a safe, understandable, and self-serve experience—without hiding complexity or shifting liability onto the system.

The Problem

At first glance, surcharging looked like a UI complexity problem without context.

In reality, it was a much deeper tension between:

- Business risk

- User anxiety

- Compliance complexity

The existing model relied on a flat-rate configuration managed through Customer Support.

This created a broken operating model:

Business pain

- Supplier churn

- CS ticket overload

- Legal and compliance risk

- Competitive disadvantage

Supplier pain

- No self-serve control

- Heavy CS dependency

- Anxiety around compliance and mistakes

The real challenge wasn’t how to make the UI simpler. It was how to let suppliers move fast without exposing them—or the company—to legal and financial risk.

How might we let suppliers move fast without exposing them to legal and financial risk?

My Role

I was the Lead Product Designer on this project and owned:

- Problem framing

- UX strategy

- Design decisions and trade-offs

- Cross-functional alignment through delivery

Constraints

- Legacy product → No mature design systems

- Limited engineering capacity(resources)

- Legal and regulatory risk

- Tight delivery timeline

Challenges → Solutions

Three Critical Challenges

1. A broken operating model

Flat-rate surcharging led to CS dependency and supplier churn.

2. Enabling self-serve without increasing risk

Suppliers needed self-serve control, but compliance anxiety remained high.

3. Shipping under real constraints

No design system, limited resources, and the need to ship quickly.

Challenge 1: What Users Actually Needed

Insights gathered from:

- Interviewing Customer support team

- Customer support team’s records with customers

- Supplier feedback

- Legal team guidance

They weren’t asking for a fully flexible rule engine.They wanted to understand what would happen—and trust that they weren’t making a costly mistake.

Users didn’t want more complexity. They wanted safe control.

Solution: Safe, Scoped Self-Serve Setup

Instead of designing maximum flexibility, PM and I intentionally scoped the solution.

Key design decisions

- State / province-level configuration

- Explicit condition building

- Visible maximum surcharge percentages (US & Canada)

- Review-first mental model before saving

Challenge 2: Guardrails Where It Matters

Not all friction is bad.

In high-risk financial flows, removing friction everywhere can create serious problems.

I focused on adding protection only at critical moments.

Solution: Guardrails included

Instead of designing maximum flexibility, PM and I intentionally scoped the solution.

- Legal-aligned disclaimers

- Confirmation modal before saving

- Clear awareness of where rates would apply

These moments slowed users down intentionally. Not to block progress, but to prevent irreversible mistakes.

Challenge 3: Shipping Fast Under Real Constraints

The solution still needed to ship quickly.

No design systems + Lacking resources

→

Reused familiar UI patterns

Engineer-friendly components

→

2 weeks delivery (Design)

1 sprint implementation (Eng)

Faster than PM expectation

Outcome & Proof

While long-term metrics were still evolving, early signals were strong:

These outcomes validated the approach without over-claiming final impact.

26%

Reduced Customer Support team dependency (tickets)

70K+

in revenue during the first week

Positive

qualitative supplier feedback

Kudos

Strong recognition from Product and CS teams

Reflection

What This Project Demonstrates

- Designing for risk, not just usability

- Strategic scoping under technical and legal constraints

- Turning regulatory complexity into clear mental models

- Knowing when to add friction intentionally

- Owning discovery → delivery → storytelling

Warning modal before user saves the surcharging

Surcharging reinforced something critical for me:

Good UX isn’t always about speed—it’s about confidence, clarity, and accountability, especially when money and compliance are involved.

Contents

Overview

The Problem

My Role & Constraints

Challenges → Solution

Reflection & Learnings

Case Study

Empowering Users Through Self-serve Surcharging

Designing Safe Self-Serve Experiences in High-Risk Financial Systems

Role

Lead Product Designer

Team

PM, Engineering squad 1

Timeline

4 weeks

Overview

Surcharging is a feature that directly impacts money, legality, and user trust.

A single mistake can result in financial disputes, legal exposure, or customer churn.

This project focused on turning a high-risk, rules-based configuration into a safe, understandable, and self-serve experience—without hiding complexity or shifting liability onto the system.

The Problem

At first glance, surcharging looked like a UI complexity problem without context.

In reality, it was a much deeper tension between:

- Business risk

- User anxiety

- Compliance complexity

The existing model relied on a flat-rate configuration managed through Customer Support.

This created a broken operating model:

Business pain

- Supplier churn

- CS ticket overload

- Legal and compliance risk

- Competitive disadvantage

Supplier pain

- No self-serve control

- Heavy CS dependency

- Anxiety around compliance and mistakes

The real challenge wasn’t how to make the UI simpler. It was how to let suppliers move fast without exposing them—or the company—to legal and financial risk.

How might we let suppliers move fast without exposing them to legal and financial risk?

My Role

I was the Lead Product Designer on this project and owned:

- Problem framing

- UX strategy

- Design decisions and trade-offs

- Cross-functional alignment through delivery

Constraints

- Legacy product → No mature design systems

- Limited engineering capacity(resources)

- Legal and regulatory risk

- Tight delivery timeline

Challenges → Solution

Three Critical Challenges

1. A broken operating model

Flat-rate surcharging led to CS dependency and supplier churn.

2. Enabling self-serve without increasing risk

Suppliers needed self-serve control, but compliance anxiety remained high.

3. Shipping under real constraints

No design system, limited resources, and the need to ship quickly.

Challenge 1: What Users Actually Needed

Insights gathered from:

- Interviewing Customer support team

- Customer support team’s records with customers

- Supplier feedback

- Legal team guidance

They weren’t asking for a fully flexible rule engine.They wanted to understand what would happen—and trust that they weren’t making a costly mistake.

Users didn’t want more complexity. They wanted safe control.

Solution: Safe, Scoped Self-Serve Setup

Instead of designing maximum flexibility, PM and I intentionally scoped the solution.

Key design decisions

- State / province-level configuration

- Explicit condition building

- Visible maximum surcharge percentages (US & Canada)

- Review-first mental model before saving

Challenge 2: Guardrails Where It Matters

Not all friction is bad.

In high-risk financial flows, removing friction everywhere can create serious problems.

I focused on adding protection only at critical moments.

Solution: Guardrails included

Instead of designing maximum flexibility, PM and I intentionally scoped the solution.

- Legal-aligned disclaimers

- Confirmation modal before saving

- Clear awareness of where rates would apply

These moments slowed users down intentionally. Not to block progress, but to prevent irreversible mistakes.

Challenge 3: Shipping Fast Under Real Constraints

The solution still needed to ship quickly.

No design systems + Lacking resources

→

Reused familiar UI patterns

Engineer-friendly components

→

2 weeks delivery (Design)

1 sprint implementation (Eng)

Faster than PM expectation

Outcome & Proof

While long-term metrics were still evolving, early signals were strong:

These outcomes validated the approach without over-claiming final impact.

26%

Reduced Customer Support team dependency (tickets)

70K+

in revenue during the first week

Positive

qualitative supplier feedback

Kudos

Strong recognition from Product and CS teams

Reflection

What This Project Demonstrates

- Designing for risk, not just usability

- Strategic scoping under technical and legal constraints

- Turning regulatory complexity into clear mental models

- Knowing when to add friction intentionally

- Owning discovery → delivery → storytelling

Warning modal before user saves the surcharging

Surcharging reinforced something critical for me:

Good UX isn’t always about speed—it’s about confidence, clarity, and accountability, especially when money and compliance are involved.